Investment Results

- Featured Image

-

At ATRF we focus on finding the right balance of risk and returns, and ensuring our investments are aligned with our strategic goals.

ATRF’s investment portfolio is structured to deliver the returns necessary to fund pension benefits over the long term. It is diversified by asset type, geography, and risk profile in order to control the impact of short-term volatility in investment markets to the extent possible.

As of 2021, responsibility for the direct management of ATRF investments was transferred to AIMCo as required by law. Today, ATRF plays the vital role of providing investment strategy that sets the direction for investing overall, and guides all the investment decisions made by AIMCo. ATRF also carefully monitors investment performance, paying particular attention to ensuring adherence to the strategy.

Long-Term Investment Performance

As a true pension manager, ATRF focuses on the long-term investment results that are needed to fund our plans. We are very pleased to report that at the end of the 2022-23 fiscal year, ATRF’s investment portfolio had earned an annualized rate of return of 8.13%, well above our benchmark of 7.75% over the trailing 10-year period.

| Asset Class | ATRF 1 Year (%) | Benchmark 1 Year (%) | ATRF 4 Years (%) | Benchmark 4 Years (%) | ATRF 10 Years (%) | Benchmark 10 Years (%) |

|---|---|---|---|---|---|---|

| Fixed Income | 0.06 | -0.10 | -2.77 | -3.06 | 1.93 | 1.95 |

| F.I. - Universe Bonds | 1.00 | 0.76 | -1.59 | -1.78 | 2.13 | 1.97 |

| F.I. - Long-Term Bonds | -1.59 | -1.72 | -5.42 | -5.43 | 2.06 | 2.23 |

| F.I. - Money Market | 4.44 | 4.22 | 1.65 | 1.51 | 1.09 | 1.13 |

| Return Enhancing | 10.95 | 16.99 | 10.23 | 10.20 | 11.10 | 10.97 |

| R.I. - Global Equity | 13.03 | 13.40 | 7.79 | 8.90 | 8.92 | 9.87 |

| R.I. - Private Equity | 7.12 | 24.51 | 17.09 | 12.35 | 19.25 | 14.00 |

| Inflation Sensitive | -4.05 | 0.59 | 5.89 | 7.39 | 9.77 | 6.78 |

| I.S. - Real Estate | -12.94 | -5.52 | 3.30 | 6.51 | 7.65 | 6.30 |

| I.S. - Infrastructure | 8.61 | 8.65 | 9.44 | 8.39 | 13.54 | 7.45 |

| Absolute Return | 4.01 | 6.81 | 4.73 | 4.48 | NA | NA |

| TOTAL PLAN | 4.39 | 8.45 | 5.73 | 6.15 | 8.13 | 7.75 |

Investment performance net of fees, as at August 31, 2023

Investment Performance Analysis

Fiscal 2022-23

Through the year, ATRF’s total portfolio generated a modest positive return of 4.4%. All of ATRF’s asset categories, apart from Real Estate, generated positive returns for the year. While that total return is modest, it represents an improvement from the prior year’s -1.8%.

The portfolio return followed general market results for the fiscal year. Markets were much improved from the prior grim year. Public equity markets generated positive returns. Fixed income markets were not in freefall as in the prior year but were weak.

While market results were better, the year was unusual.

First, the strength in global equity markets was decidedly narrow: a handful of stocks were responsible for the bulk of the increase. Second, private market activity was notably subdued. Finally, with stubborn inflation rates keeping global central banks hiking rates, the war in Ukraine dragging into its second year, and the ever-increasing tension between the US and China, real economic activity remained surprisingly firm, particularly in the US. A year ago, one would have expected to see a notable recession by now, but that has not yet happened. Indeed, at the end of the fiscal year, as with a year ago, the debate was about when the US economy would finally gag on the elixir of higher interest rates.

While the ATRF portfolio earned a positive total return for the year, the fund’s relative return for the year was, on its face, disappointing. The fund underperformed its benchmark by 4.1%. One must be careful in reacting to short-term relative performance numbers, whether good or bad. Much of the underperformance of the benchmark is due to Private Equity. While that asset class produced modest positive returns for the year, its benchmark is based on a public equity index, which rocketed higher over the year. Indeed, a similar dynamic, but running in the opposite direction, was responsible for the strong total fund outperformance discussed in last year’s annual report.

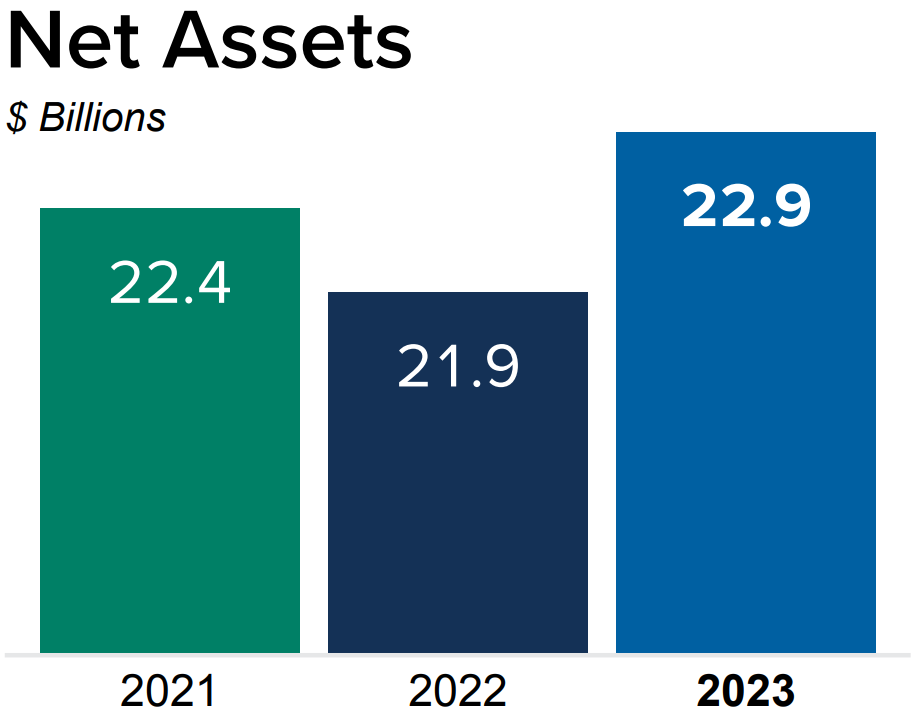

Long-Term Focus

While we are compelled to report one-year numbers, for a long-term investor like ATRF, there is much more noise than information in such brief time periods. Meaningful insights can only be gained from looking over a longer horizon. Over a 10-year period, ATRF’s total fund has generated an annualized return of 8.1%. Over the same horizon, ATRF’s total fund has outperformed its benchmark by 0.4%, net of all costs. These solid figures are key drivers behind the remarkable improvement in plan-funded status seen in recent years. Indeed, at year-end, the Plans enjoy robust good health.

The year was also notable because it was the first full year of ATRF’s new normal. AIMCo has been responsible for all day-to-day decisions regarding ATRF’s assets for the full fiscal year. ATRF remains responsible for setting the investment policy and monitoring the portfolio to ensure it is consistent with the policy. AIMCo and ATRF communicate regarding investment matters very frequently, and this communication remains respectful and productive.

Investment Policy Development

ATRF began a thorough review of its investment policy and strategic asset allocation over the fiscal year. While the work was ongoing at fiscal year-end, in the upcoming fiscal year, we expect to approve and begin to implement, with AIMCo’s assistance, a new investment policy with a revised strategic asset allocation selected to set the conditions for ATRF’s continued success in the years to come.