Electronic Bill Payments FAQ

- Featured Image

-

Online bill pay and e-Transfer are secure electronic services provided by institutions that allows you to pay bills and transfer money without using cheques.

Online Bill Pay Service

Is Alberta Teachers’ Retirement Fund (ATRF) listed on my bank’s online bill pay service?

We are currently listed with the following financial institutions:

- ATB

- BMO

- Canadian credit unions (i.e. Servus Credit Union, Canadian Western Bank, Vancity, etc.), with exclusions in Quebec, Yukon, and Northwest Territories.

- CIBC/Simplii Financial

- National Bank

- RBC

- Scotiabank/Tangerine

- TD

Is there a fee associated with the online bill pay service?

In general, there are no fees for you to use this service through your bank. However, please check with your financial institution to confirm.

Are there limits on the amount I can send?

Each financial institution sets their own daily limits. Please contact your bank or credit union for details.

How do I add a new payee to my online bill pay service?

The exact steps to add a new payee will vary by individual bank. General steps are as follows:

- Log into your online banking account.

- Select Bill Pay Service.

- Select Add a Payee.

- Search for “Alberta Teachers Retire” or other variants.

- Select the payee from the list of results (*see appendix below for examples)

- Enter your eight digit ATRF ID number, which is located on your Plan Member Statement as the account number.

- Confirm your input and complete the new payee setup.

Please contact your financial institution for further assistance.

Can I use online bill pay service to transfer funds to ATRF from my registered account, such as a Registered Retirement Savings Plan (RRSP), Locked-in Retirement Account (LIRA), etc.?

No, you can only use personal money from a non-registered account.

Other Tips

- Ensure you have a valid email address with ATRF.

- Make the payment from your bank account.

- If the payment is made from another individual’s bank account, notify ATRF at payments@atrf.com so your account is properly credited.

Appendix: Online Bill Pay Examples

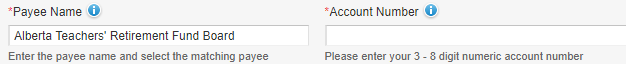

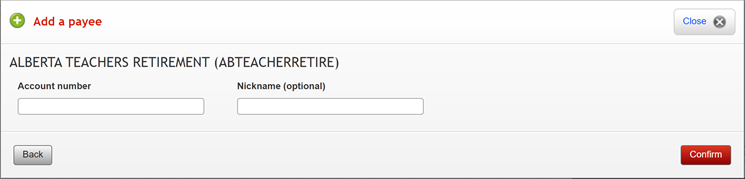

These are examples of what it looks like when ATRF is listed as a payee for online bill pay services from various banks.

Bank of Montreal (BMO): Alberta Teachers’ Retirement Fund Board

CIBC or Simplii: “ALBERTA TEACHERS’ RETIRE. FUND”

![]()

Scotiabank or Tangerine: “ALBERTA TEACHERS RETIREMENT”

RBC: “ALBERTA TEACHERS’ RETIREMNT FND BRD”

Interac e-Transfer

What is Interac e-Transfer?

Interac e-Transfer is a fast, secure and convenient way to send money to another Canadian bank account using online banking. The participating bank or credit union transfers the funds using established and secure banking procedures. The recipient is notified via email.

How secure is it to send money by email through Interac e-Transfer?

Funds are not sent by email. Email acts only as the notification to advise the recipient that the transfer has been initiated, and to provide instructions on how to deposit the money. The money resides safely with the financial institutions and is transferred through existing payment networks that banks and credit unions have used for years to settle cheques, bank machine deposits and withdrawals, etc. Strong security measures have been built into the banking systems.

How much does it cost to send money via Interac e-Transfer?

Charges (if any) may vary based on your banking plan with your financial institution. Please check with your financial institutions directly.

Are there limits on the amount I can send?

Each financial institution sets their own daily limits. Please contact your bank or credit union for details.

Can I use online Interac e-Transfer to transfer funds to ATRF from my registered account, such as a Registered Retirement savings plan (RRSP), Locked-in Retirement Account (LIRA), etc.?

No, you can only use personal money from a non-registered account.

How do I send funds with Interac e-Transfer for the first time?

How to send an Interac e-Transfer can vary by individual financial institutions. General steps to follow are:

- Log into your online banking account.

- Select Interac e-Transfers.

- Input your email address as the sender of the Interac e-Transfer.

- Select New Recipient.

- Create a Recipient Name: “ATRF”.

- Input Recipient Email Address as payments@atrf.com.

- Input the Amount.

- Select the Bank Account to withdraw the funds from.

- Add a Message with your eight digit ATRF ID number, the purpose of the funds, your contact, and other related information.

- Confirm the information and complete the Interac e-Transfer.

- No Security Question is necessary for Interac e-Transfer sent to payments@atrf.com. ATRF is registered as an Interac e-Transfer Auto-deposit, which means incoming Interac e-Transfers are automatically deposited into our bank account directly.

Please contact your financial institution for further assistance.

If I need to speak with someone after I send the funds via an e-Transfer, who do I contact?

Please contact your bank or credit union to troubleshoot any transactions in progress. Their contact information is usually listed on the back of your Interac debit card.

Other Tips

- Ensure you have a valid email address with ATRF.

- Make the payment from your bank account.

- If the payment is made from another individual’s bank account, notify ATRF at payments@atrf.com so your account is properly credited.