Contribution Rates

- Featured Image

-

Rate Announcement for September 1, 2024

The elimination of the deficit and the strong plan-funded status, along with the robust risk management levers in place, allowed the ATRF Board to reduce contribution rates (effective September 1, 2024) by a total of 2% of pay for the Teachers’ Pension Plan (TPP), shared between the members and government/employers, and a total of 1% of pay for the Private School Teachers’ Plan (PSTPP), shared between the members and employers.

- For the Teachers’ Pension Plan, starting September 1, 2024, teachers’ total contribution rate (as a % of pay) will be reduced from 10.32% to 9.29%.

- For the Private School Teachers’ Pension Plan, starting September 1, 2024, teachers’ total contribution rate (as a % of pay) will be reduced from 9.95% to 9.45%.

| . | TPP (Current) | TPP (Sept. 1, 2024) | PSTPP (Current) | PSTPP (Sept. 1, 2024) |

|---|---|---|---|---|

| Up to YMPE | 9.00% | 8.24% | 8.50% | 8.25% |

| Above YMPE | 12.86% | 11.76% | 12.15% | 11.79% |

| Total Teachers' Contribution | 10.32% | 9.29% | 9.95% | 9.45% |

| Total Government / Employer Contribution | 9.89% | 8.92% | 9.51% | 9.01% |

Current Information

The ATRF Board carefully reviews a number of factors when determining the plans’ contribution rates and adjusts contribution rates as required following each actuarial valuation.

Contribution rates are set to cover the cost of plan benefits currently being accrued, including cost-of-living adjustments. Retired members are eligible to receive an adjustment equal to 60% of the change in the Alberta Consumer Price Index (ACPI) for pensionable service prior to 1993 and 70% of the ACPI for pensionable service after 1992.

Active plan members and the Alberta Government or contributing employers share equally in funding for benefits related to pensionable service after August 1992, including the 60% cost-of-living adjustments. Active plan members are solely responsible for funding the additional 10% cost-of-living adjustments provided for pensionable service after 1992.

Plan deficiencies with respect to earned benefits must be funded over a 15-year period by additional contributions. These additional contributions are to be shared equally between active plan members and the Alberta Government or contributing employers.

However, active plan members alone are required to fund all the actual cost with respect to that portion of deficiencies related to the additional 10% cost-of-living benefit for pensionable service earned after 1992.

The Teachers’ Pension Plan deficiency for pensionable service before Sept 1992 is referred to as the Pre-1992 Unfunded Liability. The Alberta Government advances sufficient funds to ATRF to pay for all benefits for pensionable service before September 1992, as they become due.

Contributions are not deducted during strikes or leaves of absences (other than health-related periods of maternity leaves). As well, you do not contribute on any salary above the maximum pensionable salary (or salary cap) in accordance with the Income Tax Act.

If you work part-time, your contributions are based on what you would have earned working full-time in your position and then adjusted with the percentage of full-time hours you work.

Year's Maximum Pensionable Earnings (YMPE)

Your monthly contribution to the plan is integrated with your contribution to the Canada Pension Plan (CPP) and takes the YMPE into consideration. The YMPE is the year’s maximum pensionable earnings covered by the CPP.

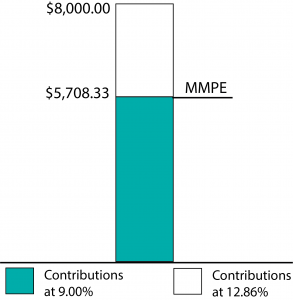

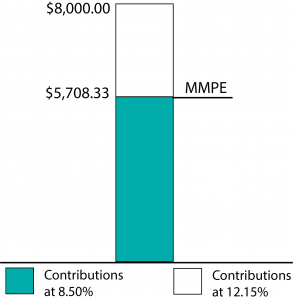

The YMPE for 2024 is $68,500, or $5,708.33 per month, which is called the monthly maximum pensionable earnings (MMPE). This maximum changes every January 1, and the amount of your ATRF contribution changes accordingly.

Contributions: Teachers’ Pension Plan - School Jurisdictions, Charter Schools and ATA Locals

Employer Contributions

As of September 1, 2023, the Alberta government or employer contribution is 9.89% of your pensionable salary.

Starting September 1, 2024, Alberta government or employer contribution will be 8.92% of your pensionable salary.

Your Contributions

As of September 1, 2023, the employee contribution rate is 9.00% up to the monthly maximum Canada Pension Plan pensionable earnings level ($5,708.33 effective January 1, 2024) and 12.86% on pensionable earnings above that level.

Starting September 1, 2024, the employee contribution rate will be 8.24% up to the monthly maximum Canada Pension Plan pensionable earnings level ($5,708.33 effective January 1, 2024) and 11.76% on pensionable earnings above that level.

An Example of 2024 Contributions

If you made $8,000 per month in 2023, you would contribute:

- 9.00% of your monthly salary up to the 2024 MMPE of $5,708.33, and

- 12.86% of your monthly salary over $5,708.33, as shown below.

This is a monthly contribution of $808.46:

- $513.75 (which is 9.00% of $5,708.33), plus

- $294.71 (which is 12.86% of $2,291.67)

| Year | YMPE | MMPE | Employee Contr. Rates (%) | Monthly Salary Cap | Monthly Employee Max | Employer Contr. Rates (%) |

|---|---|---|---|---|---|---|

| Jan 2024 | $68,500 | $5,708.33 | 9.00/12.86 | $16,754.17 | $1,934.24 | 9.89 |

CPP earnings, contribution rates and capped salaries for the TPP in previous years

Contributions: Private School Teachers’ Pension Plan

Employer Contributions

As of September 1, 2023, the employer contribution rate is 9.51% of total pensionable earnings.

Starting September 1, 2024, Alberta government or employer contribution will be 8.92% of your pensionable salary.

Your Contributions

As of September 1, 2023, the employee contribution rate is 8.50% up to the monthly maximum Canada Pension Plan pensionable earnings level ($5,708.33 effective January 1, 2024), and 12.15% on pensionable earnings above that level.

Starting September 1, 2024, the employee contribution rate will be 8.24% up to the monthly maximum Canada Pension Plan pensionable earnings level ($5,708.33 effective January 1, 2024) and 11.76% on pensionable earnings above that level.

An Example of 2024 Contributions

An Example of 2024 Contributions

If you made $8,000 per month during 2024, each month you would contribute:

- 8.50% of your monthly salary up to the 2024 MMPE of $5,708.33, and

- 12.15% of your monthly salary over $5,708.33, as shown below.

This is a monthly contribution of $763.65:

- $485.21 (which is 8.50% of $5,708.33), plus

- $278.44 (which is 12.15% of $2,291.67).

| Year | YMPE | MMPE | Employee Contr. Rates (%) | Monthly Salary Cap | Monthly Employee Max Contr. | Employer Contr. Rates (%) |

|---|---|---|---|---|---|---|

| Jan 2024 | $68,500 | $5,708.33 | 8.50/12.15 | $16,754.17 | $1,827.28 | 9.51 |

CPP earnings, contribution rates and capped salaries for the PSTPP in previous years

An Example of 2024 Contributions

An Example of 2024 Contributions