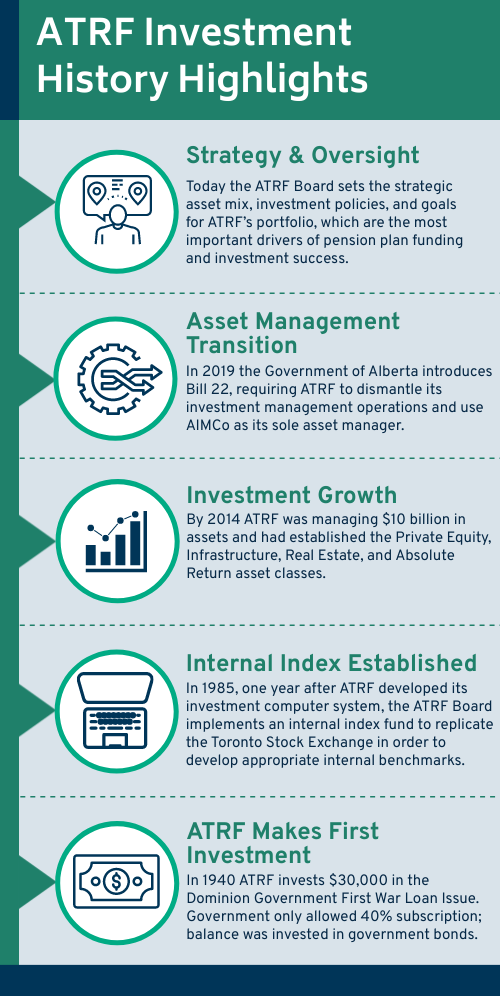

ATRF Investment History

- Featured Image

-

ATRF has responsibility for ensuring our plans’ assets are invested in accordance with our strategy and risk tolerance in order to provide returns that will fund our plans over the long-term.

ATRF has responsibility for ensuring our plans’ assets are invested in accordance with our strategy and risk tolerance in order to provide returns that will fund our plans over the long-term. Our approach to investment strategy has been developed over decades of work, and has resulted in excellent returns in recent years. The way this work is done has changed drastically over the years.

- Present

- Today the ATRF Board sets the strategic asset mix, investment policies, and goals for ATRF’s portfolio, which are the most important drivers of pension plan funding and investment success. Day-to-day management of investments is performed by AIMCo, while ATRF monitors their performance and ensures adherence to the investment strategy.

- With net assets of $21.9 billion, ATRF is 18th on the list of top 100 pension plans in Canada by asset size.

- 2021

- Transition of ATRF assets and investment management personnel to AIMCo concludes.

- ATRF and AIMCo sign an Investment Management Agreement that affirms ATRF’s vital role in setting investment strategy, and AIMCo’s role in implementing that investment strategy.

- 2019

- Government of Alberta introduces Bill 22, which requires ATRF to dismantle its investment management operations and use AIMCo as its sole asset manager.

- 2018

- ATRF initiates Project Whiteboard, a program to revise and update ATRF’s approach to asset allocation.

- 2014

- ATRF launches Absolute Return Program.

- Net assets of $10.0 billion

- 2011

- New asset classes established (Private Equity, Infrastructure and Real Estate)

- ATRF doubled its investment staff from 2009 to 2011

- 2010

- ATRF begins to launch Private Equity, Infrastructure, and Real Estate Programs

- 2000

- Net assets of $2.3 billion

- 1985

- ATRF Board implements an internal index fund to replicate the Toronto Stock Exchange in order to develop appropriate internal benchmarks.

- 1984

- First investment computer system developed.

- First Canadian Equity manager hired.

- 1954

- Fund value of $10.6 million

- 1940

- First investment ‐ $30,000 in the Dominion Government First War Loan Issue. Government only allowed 40% subscription; balance was invested in government bonds (40% Canadian, 40% Alberta, 20% Municipal)

- 1939

- The Act establishing the Teachers’ Retirement Fund (TRF) was passed by the Alberta Legislature.

- With an Alberta Government loan of $5,000, the Teachers’ Retirement Fund (TRF), was formed.