- Featured Image

-

The 2024-2025 ATRF Annual Report outlines the performance of the organization, the plans we manage, and the funds we oversee. It provides an overview of the results ATRF has achieved over the course of the year in relation to its goals and highlights some of the areas where ATRF has performed exceptionally well. It also includes the audited financial statements for the year. The ATRF Member Report provides a quick overview of key information from the Annual Report.

Highlights from the Annual Report

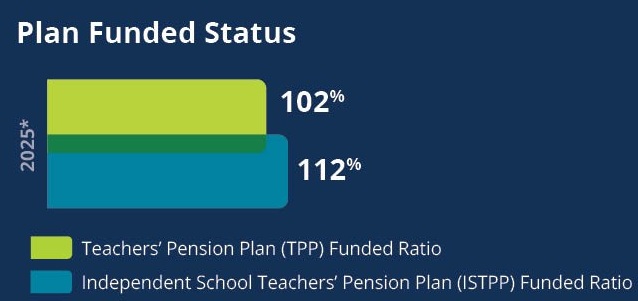

Plan Funded Status

A pension plan’s funded status is an excellent indicator of long-term viability, so we are particularly pleased to announce that both the TPP and ISTPP continue to be fully funded for the third year in a row.

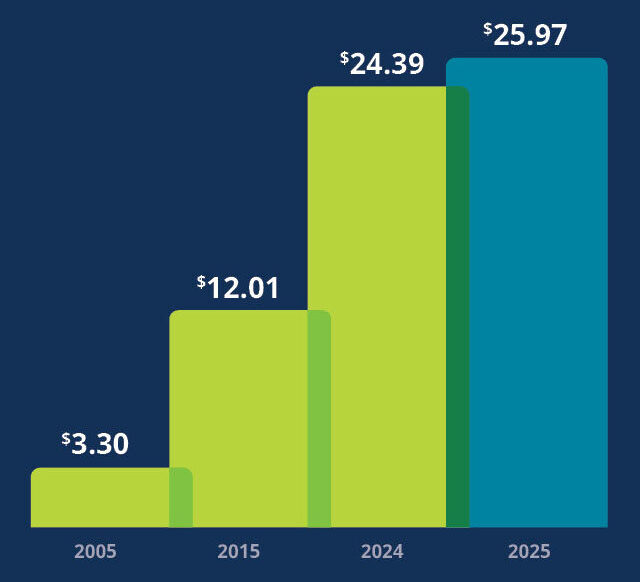

Net Assets

ATRF’s net assets have climbed to $25.97 billion, making ATRF the 17th largest pension fund in Canada by asset size.

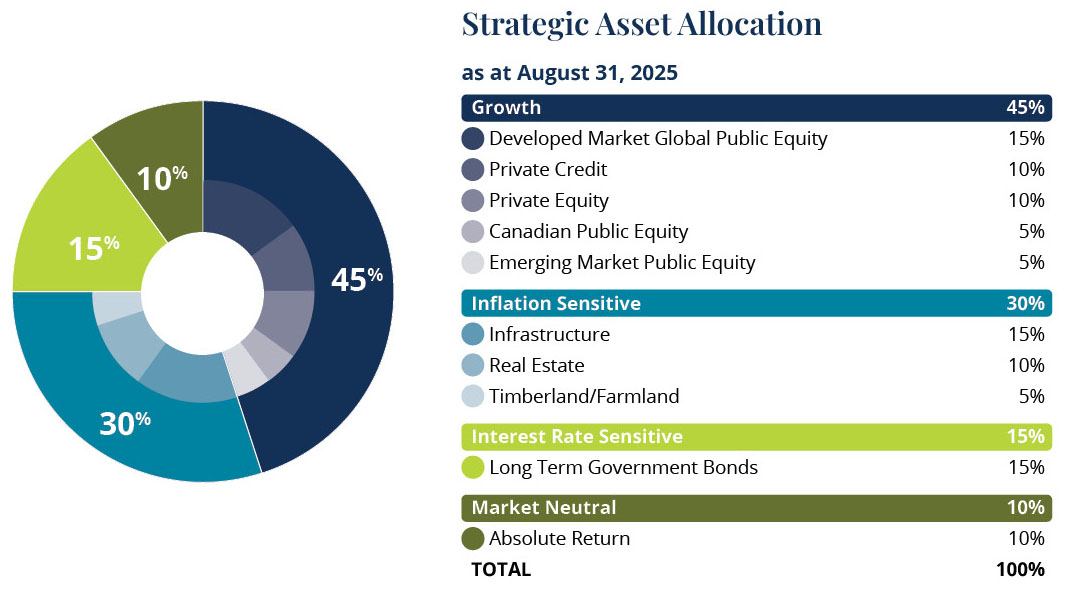

Strategic Asset Allocation

Strategic asset allocation is a key driver of long-term investment returns. The chart below shows the asset mix approved by the ATRF Board as part of its 2024 review and implemented throughout 2025.

Contribution Rates

The ATRF Board carefully reviews a number of factors when determining the plans’ contribution rates.

This year, after several contribution rate reductions in recent years, the board determined that contribution rates would remain unchanged at their current levels for both the Teachers’ Pension Plan (TPP) and Independent School Teachers’ Pension Plan (ISTPP) for the 2026-27 school year.

For the TPP, those rates are 9.29% for total teacher contribution and 8.92% for total government contribution. For ISTPP, the total teacher contribution is 9.45%, with the total employer contribution at 9.01%.

Member Satisfaction

The ATRF Member Satisfaction Survey conducted in May 2025 indicated ATRF continues to deliver consistently high levels of service, with members expressing strong satisfaction and trust in our teams’ responsiveness, accuracy, and care.

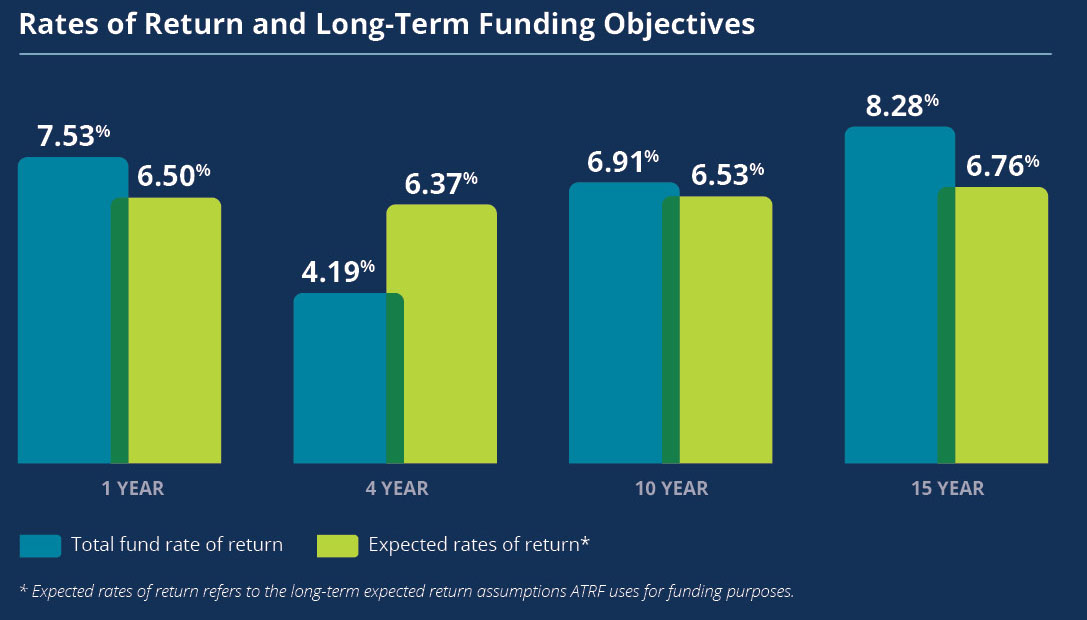

Rates of Return

We are pleased to report that the one-year total return of 7.53% exceeded the plans’ expected rate of return of 6.50%, demonstrating that the diversified asset mix delivers the investment returns required to support the long-term financial sustainability of the plans. Over a decade-long horizon that included the COVID-19 pandemic and an inflation spike, the fund generated an annualized return of 6.91%, also exceeding the plans’ expected rate of return of 6.53%.